KD Employment Law Alert: Minimum Wage Increases Only Days Away For New York Employers

By Keith J. Gutstein, Esq. and Matthew Cohen, Esq.

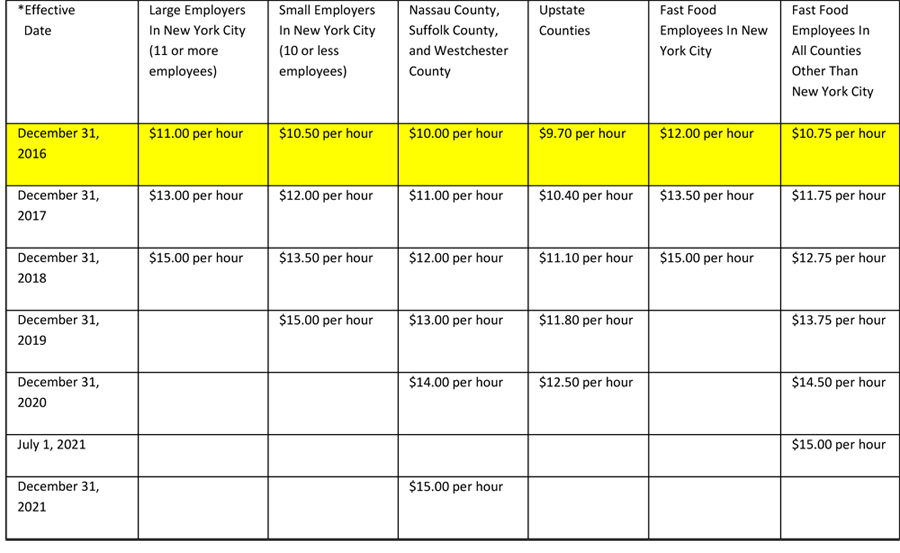

The New York State minimum wage is now on an annual incremental path to $15.00 per hour, with annual increases beginning on December 31, 2016. While the minimum wage will increase for all employers in New York, the speed of this increase and subsequent increases will vary drastically depending upon where in the State the employer is located. There will be different minimum wages for “Large Employers” in New York City (those with 11 or more employees), “Small Employers” in New York City (those with 10 or less employees), Employers located in Nassau, Suffolk, and Westchester Counties, and Employers located in all other New York counties outside of New York City, Nassau County, Suffolk County, and Westchester County (the “Upstate Counties”).

In addition, the minimum wage increases for fast food employees that started last year will continue. The minimum wage for fast food employees will increase at different rates depending on if the fast food employee is employed in New York City or anywhere else in the State.

The minimum wage increases for each location and type of employer are summarized in the chart below:

With the minimum wage increasing at varying rates across the State, tip credits for food service workers will vary depending on the county of the employer. When the minimum wage rises on December 31, 2016, employers taking a tip credit for food service workers must pay these employees hourly wages of at least $7.50 or two-thirds of the current minimum wage, rounded to the nearest five cents, whichever is higher. For example, large employers in New York City with an $11.00 per hour minimum wage as of December 31, 2016, must pay food service workers wages of at least $7.50 per hour because two-thirds of $11.00 calculates to less than $7.50. Food service workers in Nassau County who receive tips must also continue to be paid at least $7.50 per hour after the minimum wage increase on December 31, 2016.

Effective December 31, 2016, there will also be a change in the tip credit for non-food service workers, which will vary depending on the county of the employer. As of this date: (a) large employers in New York City (11 or more employees) can claim a tip credit of $1.65 an hour for an employee whose weekly average of tips received is between $1.65 and $2.70 per hour, and a tip credit of $2.70 per hour for an employee whose weekly average of tips received is $2.70 per hour or more; (b) small employers in New York City (10 or less employees) can claim a tip credit of $1.60 an hour for an employee whose weekly average of tips received is between $1.60 and $2.55 per hour, and a tip credit of $2.55 per hour for an employee whose weekly average of tips received is $2.55 per hour or more; (c) employers in Nassau, Suffolk, or Westchester counties can claim a tip credit of $1.50 an hour for an employee whose weekly average of tips received is between $1.50 and $2.45 per hour, and a tip credit of $2.45 per hour for an employee whose weekly average of tips received is $2.45 per hour or more; and (d) employers in upstate counties can claim a tip credit of $1.45 an hour for an employee whose weekly average of tips received is between $1.45 and $2.35 per hour, and a tip credit of $2.35 per hour for an employee whose weekly average of tips received is $2.35 per hour or more.

Employees are also reminded of the implications of New York’s “spread of hours” regulations. All employers who are subjected to the Hospitality Wage Order must pay any employee whose work day spans more than ten hours one additional hour’s pay at the full minimum wage rate. For employers who are not subjected to the Hospitality Wage Order, any employee whose work day spans more than ten hours must be paid one additional hour’s pay at the full minimum wage rate only if that employee’s total weekly wages are less than the total of the minimum wage for each hour worked, plus one additional hour at the minimum wage. Employers must be aware that the increase in minimum wage can potentially increase the current number of employees that are eligible to receive “spread of hours” pay. For example, if a non hospitality industry employee is earning $10.00 per hour on December 24, 2016, that employee is not entitled to “spread of hours” pay. However, that employee earns the same hourly rate on January 2, 2017, he or she is eligible to receive “spread of hours” pay.

Though the increase in the salary basis test qualifying employees to be exempt from receiving overtime pay under federal law was recently stayed by the Courts, employers in New York should note that the New York State Department of Labor recently proposed amendments to the salary basis minimums for overtime exemptions. Specifically, the New York State Department of Labor proposed that the threshold for large employers (11 employees or more) in New York City would increase to $825.00 per week, the threshold for small employers (10 employees or less) in New York City would increase to $787.50 per week, the threshold for employers in Nassau, Suffolk and Westchester counties would increase to $750.00 per week, and the threshold for upstate employers would increase to $727.50 per week. These proposed amendments, if finalized by the New York State Department of Labor, would become effective on December 31, 2016.

In light of the upcoming wage increases, employers are reminded to provide employees whose pay rate is changing with a new wage acknowledgement form to comply with Section 195.1 of the New York Labor Law, and to take the needed steps to ensure compliance with the changing law in New York.